Back in 2014 I wrote a chapter for The Role of Currency in Institutional Portfolio by Professor Levich and M. Pojarliev.In my research I debated about the growing efficiency in foreign exchange markets potentially making a more arid ground for active managers to generate alpha. Clearly some could argue about the timing of my publication on the subject as since then some strong trends have occurred in US$ crosses. In fact the last quarter of 2014 proved to be a significant localised alpha bonanza for many currency managers. This fed into much enthusiasm from managers and a regain of interest for active currency management. However since then those trends have abated and it is lean times again for currency managers who use single factor strategies. Anyhow, my study focus on long term dynamics and the secular growing efficiency of market which I suggest is driven by a cocktail of world globalisation and advances in information technology. This has enhanced in an unprecedented way the availability of information, access to market and provided a level field market pricing to market participant.

In a seminal paper Emmanuel Acar laid the theoretical background demonstrating that the expected return of directional trading rules can be attributed mainly to autocorrelations (i.e. how the daily returns of an asset are correlated from one period to another) and drift (i.e. the absolute percentage deviation of the price series). In my paper I proposed a methodology based on his finding to classify financial time price series. The below shows what was the drift, autocorrelation and volatilities of the 45 G10 FX cross exchange rates over the period 1996 to 2015.

Using significance tests for the drift and first order autocorrelation of the time series over a rolling windows of 125 days it is possible to classify each of the 45 G10 FX crosses into 6 specific behaviours, namely: Strong trend, strong mean reversion, short term trend, Long term trend + short term reversion, Long term trend + white noise, random walk. More details on this can be found in my paper. In the below I have aggregated the time dimension (i.e. long and short term) so as to end up only with three states: Trending, Mean Reverting and Random walk. The bar chart shows the percentage of time that each currency pair spent in each of those state. It is quite apparent that some currencies have had a greater propensity to trend than other (i.e. US$ and JPY crosses) and also that currencies spent most of their time in a random walk state. It is still possible to generate value in the later as long as the risk is compensated by a high level of carry. Clearly this has not been the case over recent time and may explain why so many currency managers had poor perfpormace.

The following chart shows the number of US$ crosses that have been in trending regime over the previous 750 days. It is quite clear that aside the last quarter of 2014, trends have been seldom.

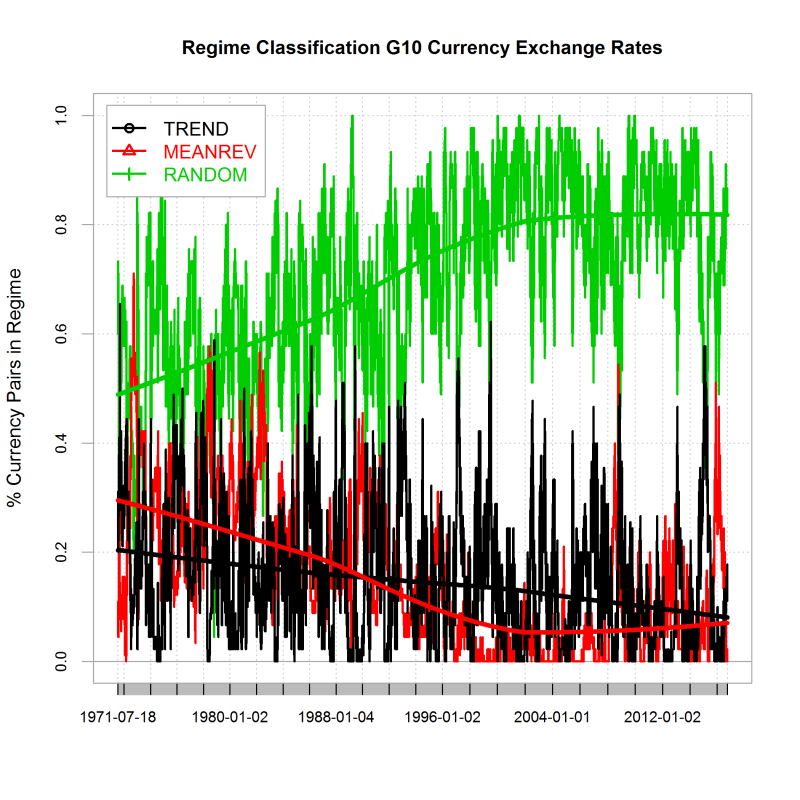

Finally, the last charts shows the number of currencies that would have been classify as trending, mean reverting or random on a rolling basis since the seventies. It is quite clear that currencies have become more random over the last few decades. This in turn means that currency manager performance has become far much more dependent on the level of carry and volatility. I am always happy to have a natter about what I produce so feel free to contact me at Pierre@Argonautae.co.uk.